Monthly Update: Purchasing Managers Index

The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Read Time: 1 minute

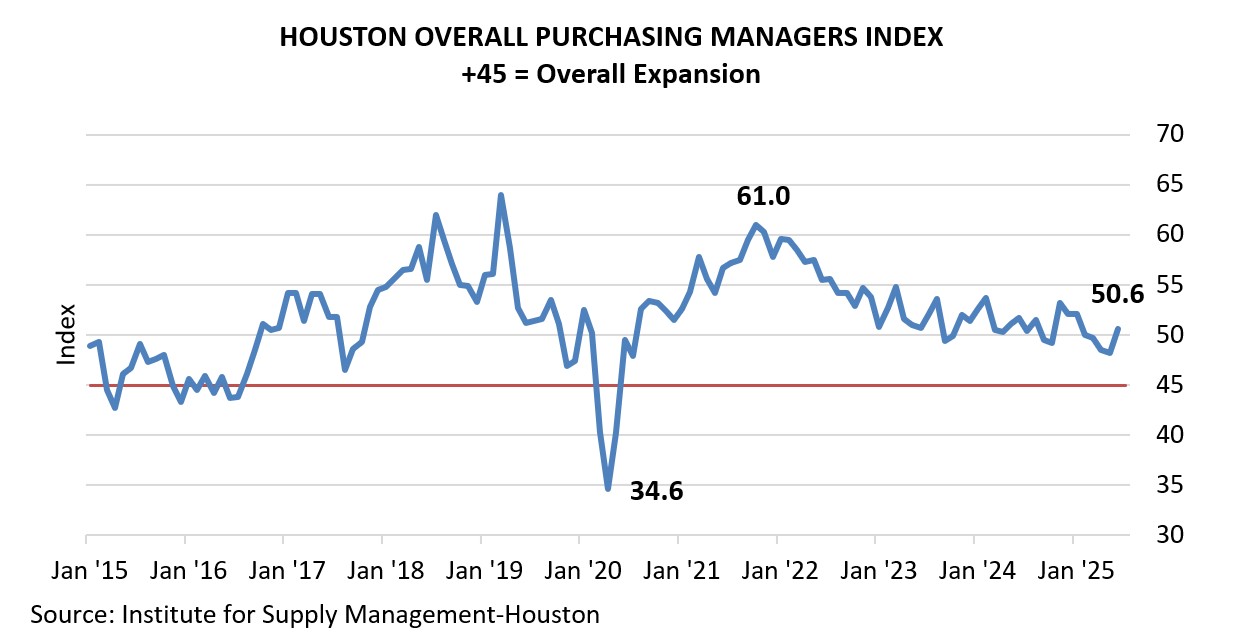

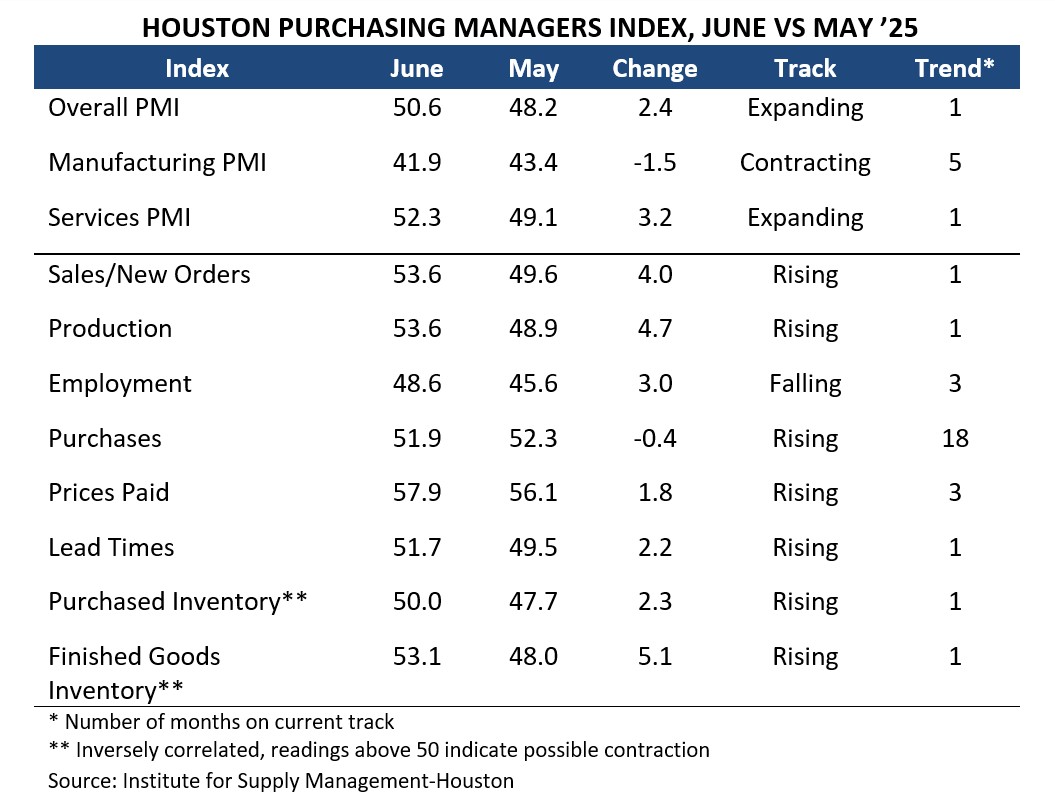

Houston’s economy expanded at a modest pace in June, according to the most recent Houston Purchasing Managers Index (PMI) prepared by the Institute for Supply Management-Houston. The overall PMI, which measures broad economic activity, was 50.6 in June, a slight increase from 48.2 in May and above the break-even point of 45, indicating economic expansion. The improvement over the previous month was driven by the non-manufacturing sector, which grew from 49.1 in May to 52.3 in June. Manufacturing, at 41.9, continued to contract with significant declines in the durable and non-durable goods sectors.

Prices paid for inputs increased for the third month following the implementation of wide-scale tariffs. At 57.9, price growth was more significant than the 56.1 experienced in May and 56.5 seen in April.

Two of the three PMI indicators most strongly correlated with Houston’s economic growth expanded:

- Sales/new orders came in at 53.6, expanding after three months of contraction.

- Employment registered at 48.6, contracting for the third month in a row but up slightly from May.

- Lead times increased to 51.7 after contracting last month.

On an industry-specific basis:

- Health care, wholesale and retail trade, and transportation and warehousing reported strong expansion.

- Oil and gas exploration and professional and business services reported moderate expansion.

- Construction reported modest contraction.

- Durable goods manufacturing, non-durable goods manufacturing, and real estate reported significant contraction.

The PMI is published monthly by the Institute for Supply Management – Houston and is based on a survey of supply chain executives in the region. For additional information, click here.

Prepared by Greater Houston Partnership Research

Clara Richardson

Analyst, Research

Greater Houston Partnership

crichardson@houston.org

Colin Baker

Manager of Economic Research

Greater Houston Partnership

bakerc@houston.org