Monthly Update: Vehicle Sales

The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Read Time: 1 minute

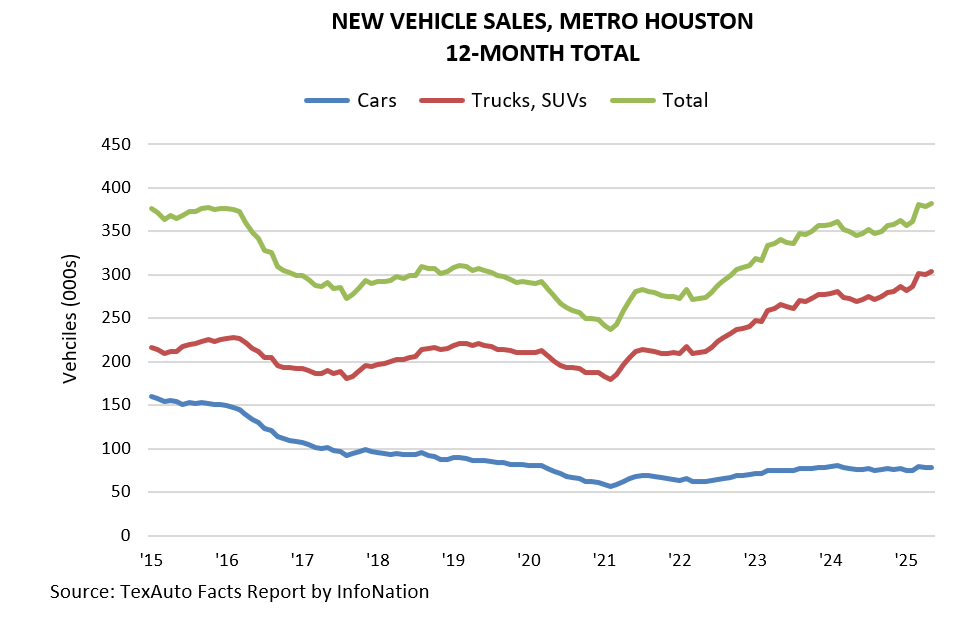

Houston-area dealers sold 381,526 new cars, trucks, and SUVs in the 12 months ending May ‘25, according to TexAuto Facts, published by InfoNation Inc. This represents a 10.4 percent increase in sales over the same period last year. Truck and SUV sales were up 12.6 percent, and car sales were up 2.6 percent.

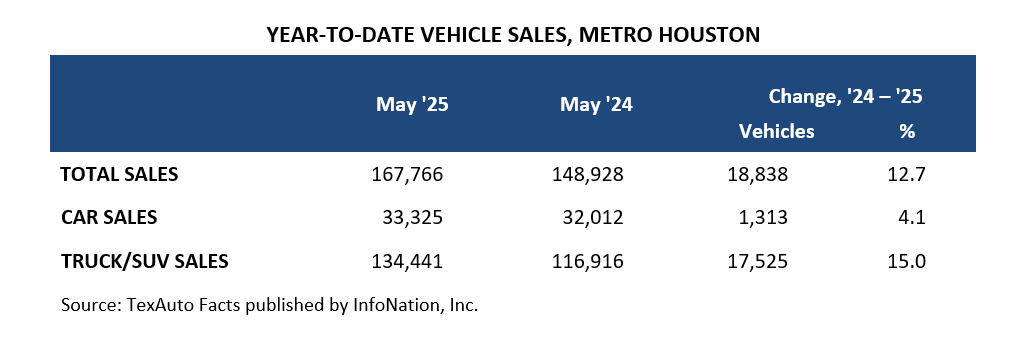

Vehicle sales rebounded last month after falling in April. Monthly sales in May came in 10.9 percent above last year and 8.0 percent above April ’25. Total sales in the first five months of ’25 remain strong, coming in 12.7 percent above the same period in ’24.

Continued uncertainty around price increases may be contributing to higher demand. Last week, President Trump stated he was considering an increase to auto tariffs above their current 25 percent level, which could further raise vehicle prices and encourage buyers to act before the changes go into effect.

Year over year, overall prices increased, with truck and SUV prices decreasing and car prices increasing over May ‘24:

- The average retail price for all new vehicles was $51,910, up from $51,665.

- The average retail price for a new truck/SUV was $54,539, down from $54,639.

- The average retail price for a new car was $41,073, up slightly from $41,056.

Prepared by Greater Houston Partnership Research

Clara Richardson

Research Analyst

crichardson@houston.org

Colin Baker

Manager of Economic Research

bakerc@houston.org