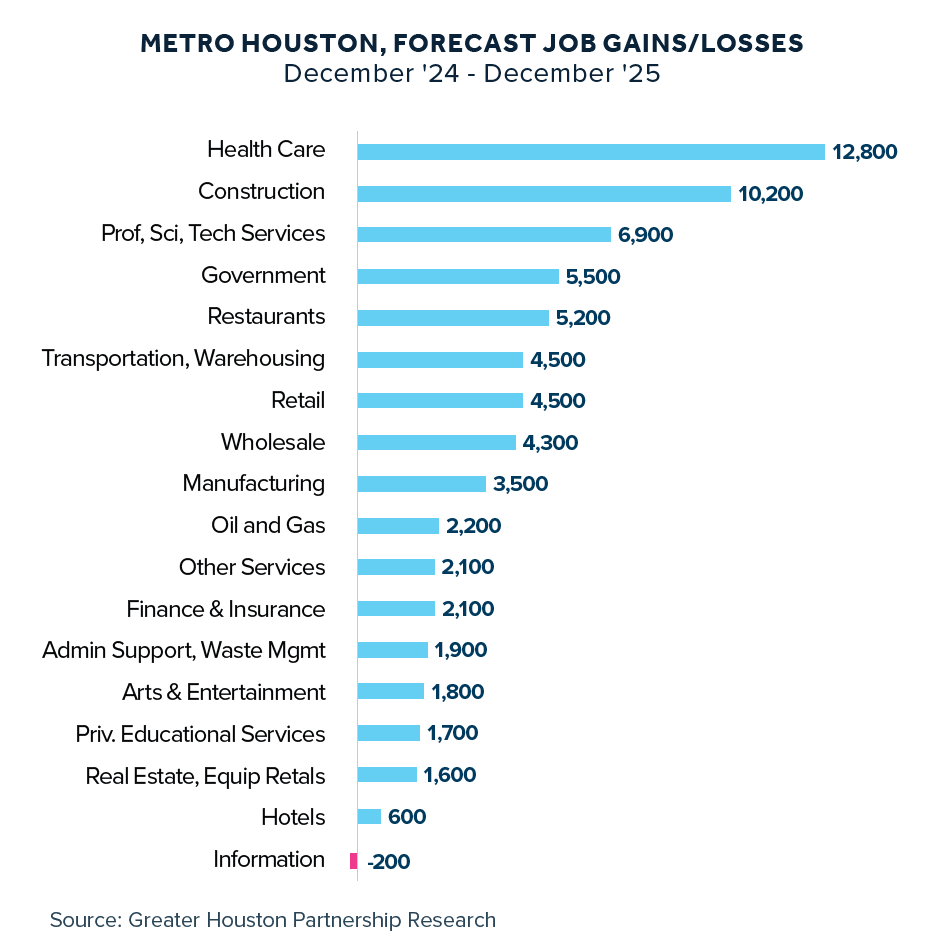

Greater Houston Partnership Forecasts Over 71,000 Jobs in Metro Houston for 2025

Published Dec 12, 2024 by Brina Morales

HOUSTON (Dec. 12, 2024) — The Greater Houston Partnership has released its forecast for job growth in the Metro Houston area, forecasting the creation of 71,200 jobs in 2025.

The sectors expected to experience the greatest gains, in order, are:

- Health care

- Construction

- Professional and technical services

- Government

- Restaurants and bars

Houston is projected to finish 2025 with over 3.5 million payroll jobs, setting a record for the region. Several factors support this growth, including the ongoing expansion of the U.S. economy, the continued decline in interest rates, increasing consumer confidence, and a steady influx of domestic and foreign companies establishing operations in Houston.

Additionally, a deep backlog of construction projects and local income and population growth contribute to the positive outlook for job creation.

“Over the past two decades, Houston has experienced several recessions, devastating weather events and the COVID-19 pandemic, but despite these events, the Houston region’s economy has remained competitive,” Partnership Chief Economist Patrick Jankowski said. “Houston’s GDP has grown 70 percent after adjusting for inflation, and that growth is proof that our resilient economy will encourage continued growth for years to come.”

According to the forecast, every sector except information is expected to experience job growth next year. The information sector has struggled for years, losing jobs in 12 out of the last 20 years, largely due to technological advancements and shifting consumer preferences.

The Houston region created 60,000 jobs in the 12 months ending October 2024. The region should end the year with 58,000 jobs.

The national outlook is also looking positive. The probability of a recession over the next 12 months sits at 26 percent, according to The Wall Street Journal’s October survey of prominent business economists.

A sector-by-sector breakdown of the jobs forecast and the factors impacting each industry can be found in the full report.

###

Media Contact

Brina Morales

Director, Communications

bmorales@houston.org

Press Releases

Press Releases