Houston Emerging as a Premier International Sports Destination

Published Nov 06, 2023 by Taylor Tatum

Houston, also known as the Bayou City, Space City and the Energy Capital of the World, might be adding another title as it is rapidly gaining recognition as an international sports city.

After years of bidding for and hosting small-scale events, the Houston region has successfully secured and will host a series of major sporting events in the upcoming years, including the 2024 College Football Playoff National Championship, 2026 FIFA World Cup, and the 2025, 2027 and 2031 AAU Junior Olympic Games. Houston also recently hosted the NCAA Final Four, LPGA Chevron Championship in The Woodlands, and has been announced as a host city for several 2023 CONCACAF Gold Cup matches.

According to a recent report from OLBG, Houston is the sixth most valuable sports city in the U.S. in terms of revenue generated from NFL, NBA, MLB, NHL, and MLS teams and predicted revenue growth, but it is projected to move into the top five by 2030. Speculations abound that Houston may soon welcome an NHL team, as reported by the Houston Chronicle, which could further bolster its rankings.

Despite Houston's wins, the city was ranked No. 29 in a recent evaluation of the 50 best cities for sports business by the Sports Business Journal, behind Dallas, Austin, and San Antonio. Criticisms revolved around Houston's sprawling nature and lack of walkability. Another concern raised was the relative freshness of its venues, with three of its major stadiums—NRG Stadium, Daikin Park, and Toyota Center— having been constructed in the early 2000s. Shell Energy Stadium is the newest major stadium, opened in 2012.

Beyond the 350-acre complex housing NRG Center, NRG Arena and the Astrodome, the absence of appealing establishments such as restaurants, bars, and hotels for visitors detracts from Houston's identity as a sports city, according to Houston First CEO Michael Heckman.

To address this, Houston First and organizations like the South Main Alliance's Main Street Coalition are actively exploring comprehensive plans to develop the area and attract commercial developers to this currently underdeveloped region.

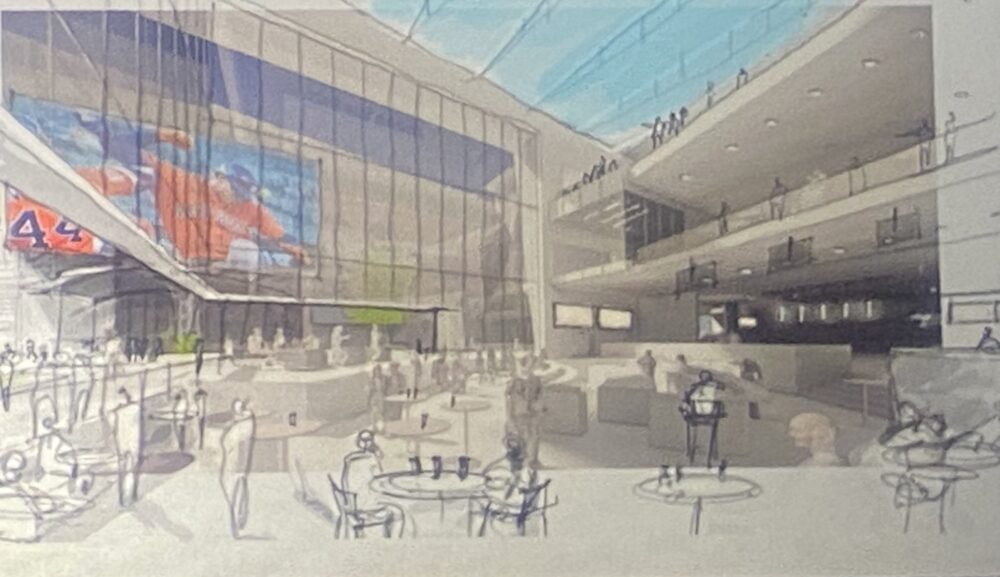

The Houston Astros recently announced plans for an entertainment district adjacent to Daikin Park that will feature a 17-story hotel, 60,000 square feet of retail space for restaurants and shops and a three-level gathering area for fans to watch Astros games and other major sporting events on a massive outdoor screen. The venue will also host live music performances. The Astros expect to break ground in November 2024.

NRG Park also has plans to revamp its complex over several years while Daikin Park has recently completed upgrades to its video display technology as part of a new partnership with Samsung, in addition to its 8,500-square-foot team store constructed at center field and new food options.

In an interview with the Houston Business Journal, Heckman stated that “the trend [for cities] is to create these entertainment districts around the sports and entertainment complexes. For us, I think it's a phenomenal opportunity to learn lessons from the others that have done this around the country, but also to make it uniquely Houston.”

While there are currently no definite plans, NRG Park CEO and Executive Director Ryan Walsh believes that the area around the complex is “really ripe for development. Give it five years... I think you're gonna see a lot of change in this area.”

Learn more about living in Houston.

The Houston Report

The Houston Report