How a Swampy Land Became the World’s Energy Capital, the Houston Phenomenon

Published Jun 14, 2022 by David Ruiz

Originally founded in 1836, the magnificent city of Houston has since become a multilingual referent of space exploration, medicine and petroleum. And although stethoscopes and rocket ships have shined a direct spotlight to the city’s innovation, its abundance of energy opportunities have spearheaded the region into an enviable status; the Energy Capital of the World. We look back at the events that led the city to an unparalleled, global dominance in energy.

1901

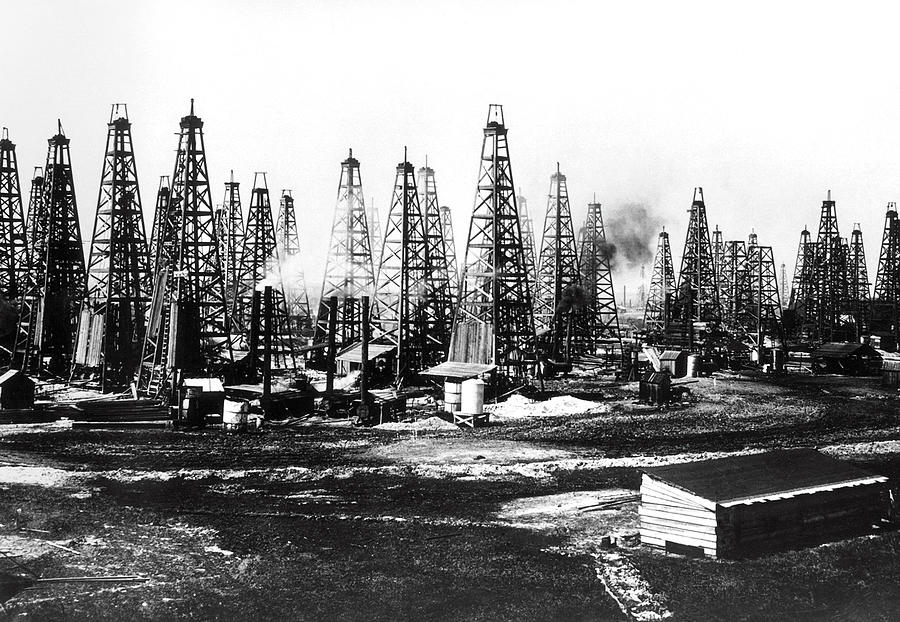

The Globe’s Greatest Gusher in Beaumont – The first stone

"It’s equal cannot be seen on this earth,” Captain Anthony F. Lucas told a Houston Post correspondent the Friday afternoon of January 10th, 1901, as a Spindletop oil well gushed 150ft into the air. For nine days, the ‘Lucas gusher’ flowed at approximately 100,000 barrels of crude oil per day (bpd), forming an oil lake beneath at the base.

While oil had previously been discovered elsewhere in the South, the Spindletop discovery laid the first stone in the Gulf Coast oil industry due to the magnitude and pressure of its underground oil vault. According to a report, an estimated $235 million was invested in Texas during the year of discovery, equivalent to about $7.9 billion in modern day. The investments in the region were devoted to product development, research and exploration. Many towns in and around Beaumont set up for a discovery of their own – the state’s petrol ventures had begun.

1905

Discovery of the Humble Oil Field – The overt ROI

The second biggest oil jackpot was hit only 208 weeks and 2 days after the Spindletop oil fountain. Less than 20 miles northeast of downtown Houston, Humble Oil company discovered a salt dome field, developing the area’s potential in oil. The discovery well produced about 8,500 bpd so others were installed nearby, raising the monthly production to about 500,000 barrels by the second month. While the discovery helped establish a reputation for Texas Gulf Coast oil, the production of oil in Humble revolutionized the town’s leading industries, placing petrol ahead of lumber.

Humble Oil company later became ExxonMobil, which most recently (Jan. 2022) announced a HQ relocation to Houston from the DFW area.

1914

Houston Ship Channel Established – The oil artery

In November of 1914, President Woodrow Wilson remotely fired a Texas cannon in Houston from the White House, signaling the inauguration of the Port of Houston, now No.1 in the U.S. by tonnage. The official opening marked the 5th improvement project for the channel and, by far, the most important. The 2-year project reshaped the channel for ocean-going vessels, facilitating the international exports of mineral fuels, oil and other petrochemical goods, its #1 main exporting product.

In May of 2022, Port of Houston announced an 11th project aimed to widen and deepen the channel, confirming the unparalleled oil [production : exportation] ratio that has been maintained for over a century.

1920

Baytown Refinery Begins Operation – The place to be

Twenty-five miles east of downtown, the ExxonMobil Baytown Refinery began operations along the Houston Ship Channel. Adjacent to the Houston Port, the 3,400-acre location provided an ideal location for oil exportation along with dedicated space for production, research & development. The proximity model was followed by many oil companies that later positioned a refinery in the area. By 1930, ten years after the refinery began operation, seven other companies had already established a refinery nearby including Chevron and LyondellBasell.

The Baytown Refinery remains the largest refinery in the United States and the second largest in the Western hemisphere, showcasing Houston’s oil supremacy.

1942

Exxon Inventors Revolutionize Petrol Industry – Historic, global ties

A couple of decades into petrol processes, engineers of what is now ExxonMobil drastically improved the process of fluid catalytic cracking, allowing a greater amount of high-octane gasoline products from crude oil. Donald Campbell, Homer Martin, Eger Murphree and Charles Tyson developed the process that is still used to develop over half of the world’s gasoline. According to historians, the process allowed for jet gas production to increase by 6,000% over three years, which was instrumental for the Allies’ WWII efforts.

Today the process remains vital for refinery operations and produces gasoline, heating oil, fuel, propane, butane, and chemical materials for plastics, rubbers, fabrics and cosmetics. The discovery is considered one of the most significant chemical engineering achievements of the 20th century, according the North American Catalysis Society.

1971

Shell Leads Wave of Relocations – Welcome to Houston, y’all

In the summer of ’69, Shell Oil Company announced it was relocating its manufacturing, transportation and marketing departments to Houston by the second half of 1970 following a year-long study on the region. “The headquarters for the Shell Development Company and for the Shell Companies Foundation, Inc. will remain in New York City,” a New York Times article reported on August 15. In October of 1971, Shell announced a plan to “centralize almost all of its major research activities at Houston, its new headquarters city,” Reuters reported.

One year into their departmental relocations, Shell packed the HQ and moved to Houston. Like Shell, over 200 other firms in the U.S. moved to Houston in the ‘70s. The relocations along with natural migration to the city, increased employment and per-capita income, propelling Houston to become the fastest growing U.S. city of the decade, according to the Census.

1973

Fuel Fuels the Economic Boom of 1973-1981 – Forging Houston

In late 1973, the United States was embargoed by Middle Eastern oil countries for supporting Israel in the Arab Israeli war. While the oil restraint disrupted the national economy, the opposite occurred in Houston. Private oil producers multiplied their investments to surge production and exploration. With this soar in production and local efforts to meet the nation’s demand for oil, a migration of businessmen, geologists, millionaires, middle-class working men and a versatile workforce resettled in Houston.

From the mid-1970s to the early ‘80s, Houston experienced a once-in-a-lifetime growth fueled by the oil industry. Along with oil profits and investments being reflected through urban infrastructure and quality of life, the city diversified and began molding into a global metro. From 1970 to 1980, Houston became the only Texas city to reach the top 5 in population. Currently at No. 4 (2022), the Texas dominance prevails.

2001

Officializing the Energy Corridor – Saluting the concentration of firms

Since 1970, the West Houston area has been a prime location for oil corporations, but in 2001, the district was officially established. The Texas Legislature designated 1,700 acres for the Energy Corridor Management District. Since it’s establishment, the district has been heavily involved in infrastructure improvements, greenspace development and beautification projects. Though the area had been steadily increasing since the ‘70s, its property valued tripled from $600 million to over $2 billion between 2001-2013.

The proximity to downtown, the Houston Port, as well as the up-and-coming status during the late 20th century, allowed for the area to become one of Houston’s strongest office markets. ConocoPhillips, Citgo, bp America and Equinor are some of the global companies with headquarters in the Energy Corridor. The district continues being a selling point for energy firms looking to relocate or expand to the Houston market.

2013

Upsurge of Chemical Plants – Investing in Natural Gas

A $60-bllion boom of chemical plant constructions in the area drove Houston’s economy to greater heights in 2013. The chemical plants investments came as an effect of natural gas price collapse of about 50% following the U.S. fracking revolution. At the time, natural gas barrels outside of the U.S. were priced at about $100 per barrel, in Houston only $15-$20. The price difference mainly due to the region’s vast reserves attracted many global companies to relocate, expand and invest in Houston. The most impactful plans were Chevron’ Phillips Baytown/Polyethylene plant ($5 billion), Dow Chemical Freeport plant ($4 billion), and LyondellBasell Channelview/La Porte plant ($500 million).

The projects brought thousands of jobs to Houston, mainly in the construction and energy operations sectors. The investments fortified the region’s economy and strengthened the backbone of the energy industry.

2021

Houston sets for Energy Transition – Exercising our DNA of innovation

In summer of 2021, the Greater Houston Partnership, in conjunction with the Center for Houston’s Future and McKinsey, unveiled the plan for Houston to lead the global energy transition to an energy-abundant low-carbon world. The plan was produced as an effort to continue meeting the world’s energy demand while lowering climate-changing emissions. Energy companies supporting the transition include Chevron, Conoco Phillips, ExxonMobil, Shell, bp America, Schlumberger and other many other who have pledged to play a role in the transition.

While the city has grown immensely over the past century, its innovative, problem-solving and energetic determination to adapt and overcome has slowly been carved into the region’s DNA. The cadence of discoveries and growth will fuel Houston’s leadership role in a global, clean-energy transition.

Learn more about Houston’s history.

The Houston Report

The Houston Report